Keynote Panel: Green Commodities: Balancing Expectations without Valuations

Grand Ballroom 1

May 7th Plenary

Policy and RegulationESGFinance and ContractsGreen Commodities

Information

While mining is actively engaged in decarbonisation, the price premium for producing green commodities is not here yet. This is one of the core challenges of mining’s net zero transition: how to finance decarbonisation in line with targets and stakeholder expectations when the green price premium hasn’t arrived. This keynote panel will provide critical insight into this complex challenge.

- What does the green premium look like and has it arrived?

- What are end users/customers, and investors looking for from miners in terms of green credentials?

- What impact has the recent price drop for critical minerals had on the discussion around green premiums for ESG-friendly commodities?

- How and when will net zero and ESG-friendly translate into a price differential for mining companies?

- How are miners addressing the challenge of financing decarbonisation without a price signal?

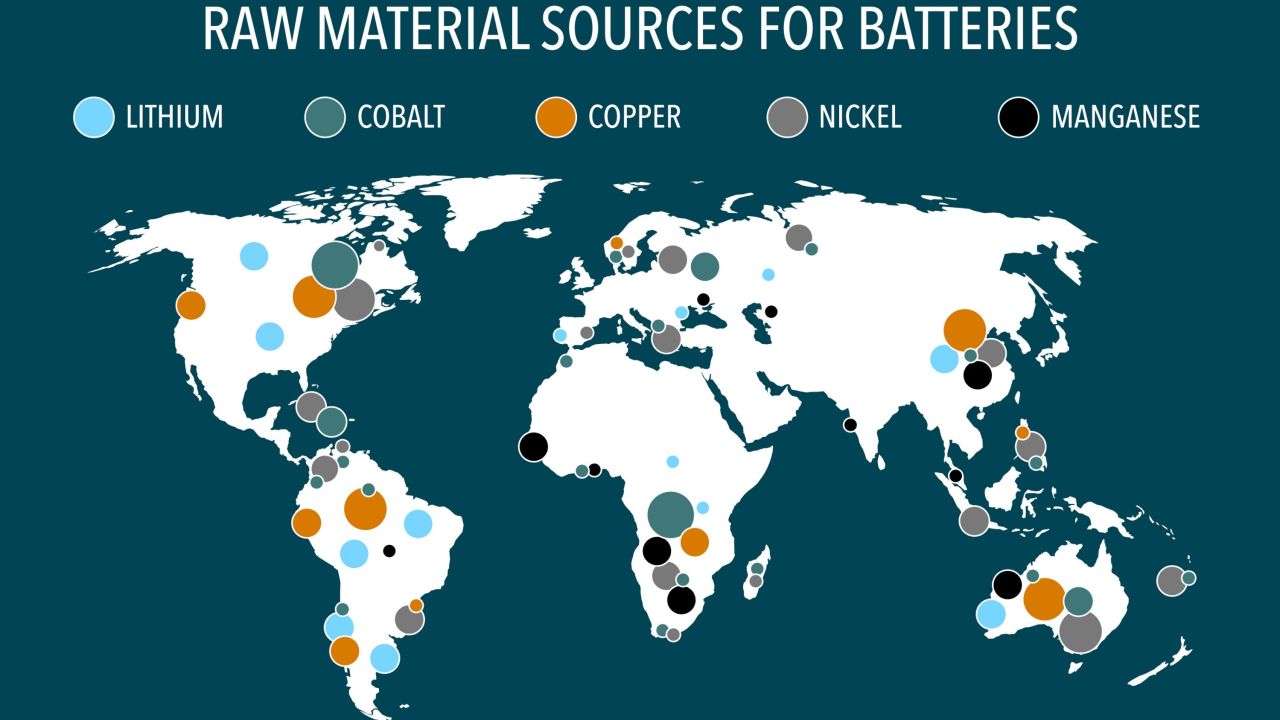

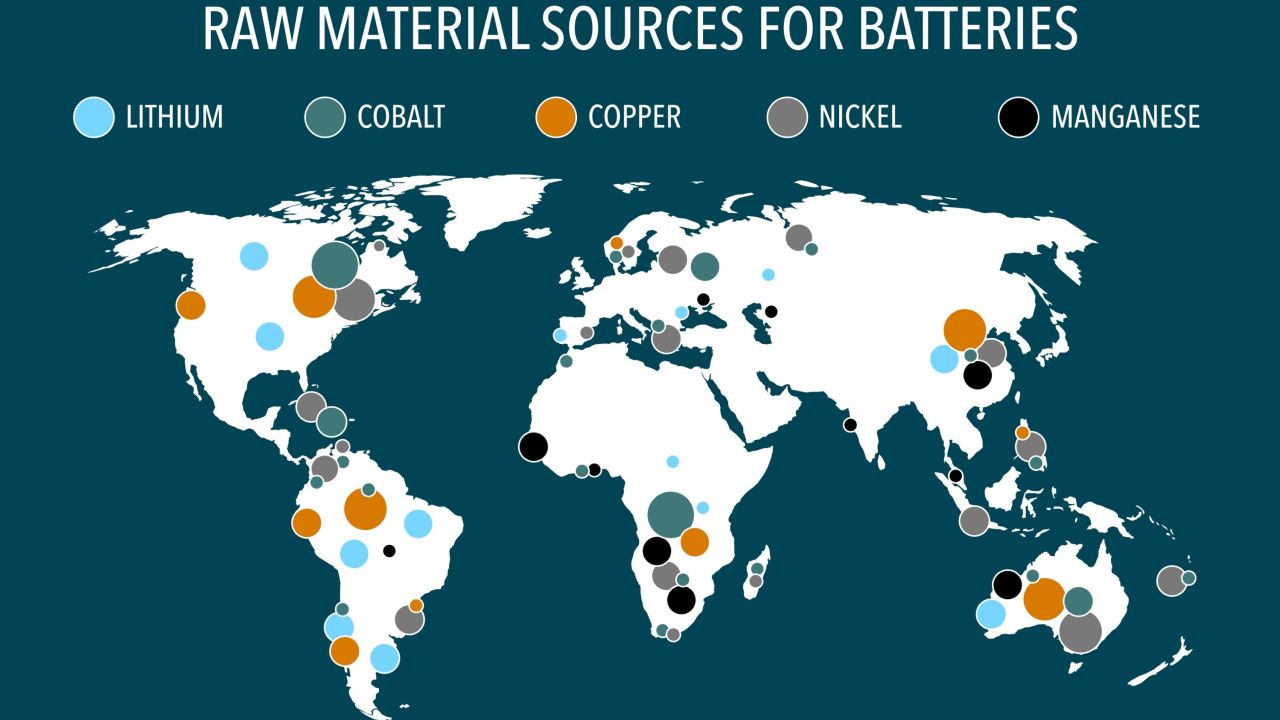

- How are automakers and battery manufacturers sourcing low-carbon inputs across their supply chains?

- What is the outlook for demand for low-carbon commodities and how can miners position themselves as “green commodity suppliers”?

Speakers

Jo Garland

PartnerHFW Australia

Dev Tayal

Policy and Business DevelopmentTesla

Richard Proudlove

Director of Corporate EngagementInvestor Group on Climate Change

Georgina Hallett

Chief Sustainability OfficerLondon Metal Exchange

Stuart Tarrant

CFOLithium Australia

Braden DUNSMORE

VP Safety & SustainbilityWyloo